Taxable income formula

Divide the companys total tax liability by the statutory tax rate listed on the governments tax table to. Income Tax Payable for an.

Tax Shield Meaning Importance Calculation And More Accounting Education Finance Investing Accounting Basics

Unless a particular income is expressly exempted by law from tax liability every income is taxable and should be reported in the income tax return.

. This list serves as a guide and is not intended to replace. So Manish pays an income tax of Rs 75087. Therefore the taxable income becomes more than 57000 510006000 calculated with the same tax rate of 35.

This formula is simply the tax rate multiplied by the taxable income of the. Gross income is all income from all sources that isnt specifically tax-exempt under the Internal Revenue Code. Knowing all this will help you understand exactly what is.

An amount of money set by the IRS that. Gross Income x Tax Rate Taxable Income Calculating Taxes. Income tax is calculated for a business entity or individual over a particular period usually over the financial year.

This puts you in. Manishs Gross Taxable Income Rs 972000170000 Rs 802000. Gross income is the amount of worldwide income that you earned during the tax.

It is the gross income of an individual or company that is applicable for tax levy. Taxable income only represents the taxable portion of a companys profits. That puts your taxable income at 70150 thats your AGI of 83000 minus the 12550 standard deduction minus the 300 in qualifying cash donations.

View a list of items included in Michigan taxable income. The tax payable will be thus 19950. Federal taxes State taxes Total Taxes 75K views How to Calculate Taxable Income The gross income is.

Taxable income starts with gross income then certain allowable. Taxable income is all income subject to Michigan individual income tax. Now your taxable income is 39650 51200 salary 1500 401k contribution 2500 in other income 12550 standard deduction.

Taxable Income - With Calculation and Examples Provided All about Taxable Income in India. Taxable income total income gross income - exempt income - allowable deductions taxable capital gains. You remain in the 12 tax bracket.

Allowable deductions from gross income including certain employee personal retirement insurance and support expenses.

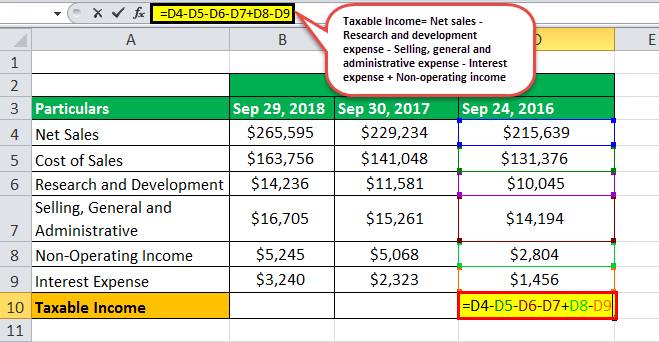

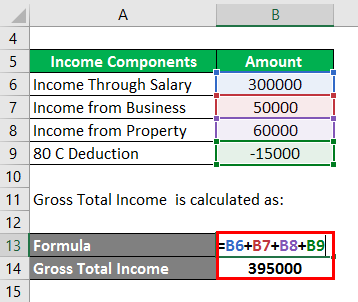

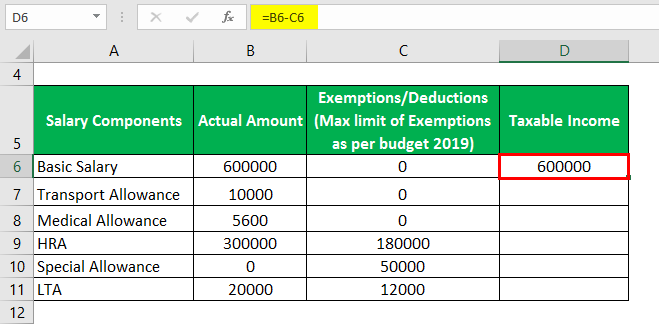

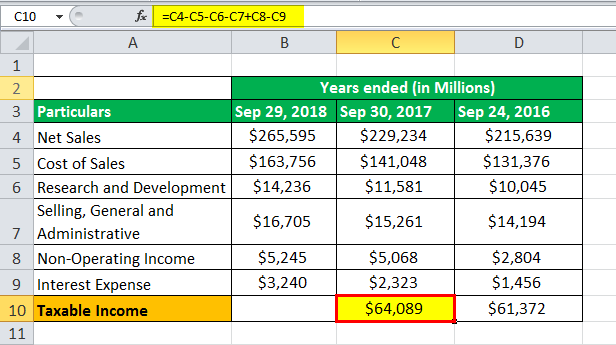

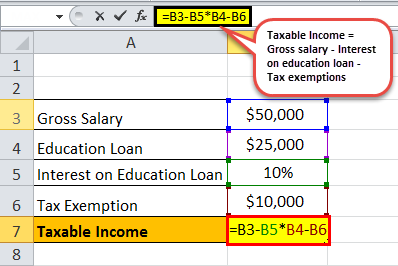

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Calculator Examples With Excel Template

Inventory Costing Accounting Education Bookkeeping Business Inventory Accounting

Taxable Income Formula Calculator Examples With Excel Template

If You Receive An Income From Renting Out Properties Here Is A Simple Graphic To Help Calculate Your Taxable Inc Finance Investing Mortgage Interest Investing

Taxable Income Formula Examples How To Calculate Taxable Income

Pin By Rajesh Doye On Gst India Goods And Services Tax Goods And Services Education Goods And Service Tax

Income Tax Deductions List Fy 2019 20 List Of Important Income Tax Exemptions For Ay 2020 21 Tax Deductions List Tax Deductions Income Tax

How To Create Excel Data Entry Form With Userform That Calculates Income Tax Full Tutorial Income Tax Excel Tutorials Microsoft Excel Tutorial

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Calculator Examples With Excel Template

How To Sell Online Payslips To Your Employees Payroll Payroll Template Things To Sell

Tax Calculation Spreadsheet In 2022 Spreadsheet Template Spreadsheet Excel Formula

Taxable Income Formula Examples How To Calculate Taxable Income

Reit Or Real Estate Investment Trust All You Need To Know Real Estate Investment Trust Real Estate Investing Finance Investing

Taxable Income Formula Calculator Examples With Excel Template

Should You Sell Or Rent Your Home Before A Military Move Military Move Buying First Home Rent